What is Grand Capital?

Grand Capital is an online brokerage that claims to have been in business since 2006, offering over 500 trading instruments, including Forex, CFDs, gold, cryptocurrencies, and more. According to its website (grandcapital.net), it provides access to 11 asset classes, personal account managers, loyalty programs, copy trading, and even an affiliate program that supposedly pays millions of dollars in commissions each year.

The broker advertises itself as a global brand, boasting over 1.5 million clients, operations in 144 countries, and 25 professional awards. It also claims to operate under the name Grand Capital Ltd, with a registered office in Seychelles and business premises at a different address in the same country.

At first glance, all of this may seem impressive. However, a deeper look reveals troubling facts that raise serious concerns about its trustworthiness.

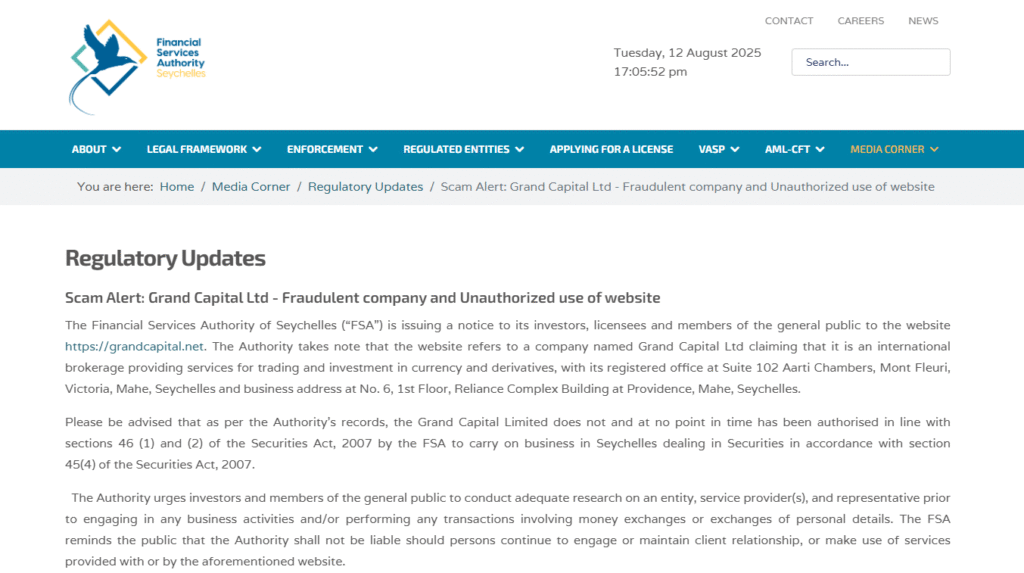

The Big Problem – Regulatory Warning from Seychelles FSA

The most striking red flag about Grand Capital is the official warning issued by the Seychelles Financial Services Authority (FSA). On 22 April 2024, the FSA publicly cautioned investors, licensees, and the general public against the website grandcapital.net, noting that Grand Capital Ltd was not a licensed or regulated entity in Seychelles.

This is highly significant because the broker’s website gives the impression that it is registered and compliant in Seychelles. In reality, the regulator itself is warning people not to trust it.

No Valid Regulation

When assessing the legitimacy of an online broker, regulation is one of the most important factors. Regulated brokers are supervised by recognized authorities such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or CFTC (USA). These bodies require brokers to meet strict operational standards, including:

- Keeping client funds in segregated accounts

- Submitting regular audits and reports

- Following transparency and disclosure rules

- Providing investor protection in case of disputes

Unfortunately, Grand Capital does not have any top-tier regulation. Its website does not display verifiable regulatory information, and there is no proof that it operates under any trusted governing body. This means no legal protections for investors’ funds.

Why This Is a Risk

Unregulated brokers can operate without oversight, which opens the door for a variety of unethical practices, such as:

- Price manipulation

- Refusal to process withdrawals

- Sudden account closure without explanation

- Misleading promotional tactics

Without a regulator to hold them accountable, traders have very little recourse if their funds are lost. This is exactly why dealing with a broker like Grand Capital is considered high-risk.

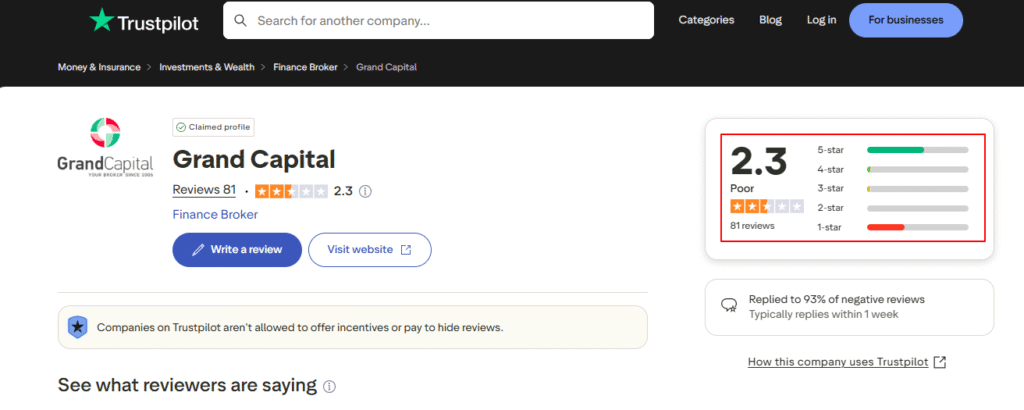

Negative Reputation and Poor Trustpilot Score

Another serious concern is the broker’s Trustpilot rating of 2.2 out of 5, which falls under the “Poor” category. The majority of reviews are negative, with users reporting issues such as:

- Withdrawal delays or refusal

- Poor customer service

- Misleading bonuses that lock funds

- Aggressive marketing and upselling

Similar complaints can be found on other platforms, including reviews.io, where multiple traders share their bad experiences with the company.

Website Claims vs. Reality

Grand Capital’s website presents an image of a sophisticated, globally recognized broker. Some of its key claims include:

Trading Instruments

- Over 500 assets in 11 classes

- Multicurrency accounts

- Various account types (Standard, MT5, Micro, ECN Prime, Swap-Free)

- Specialized categories for Gold, Crypto, and Forex

Copy Trading Platform

- Options for both investors and traders

- High returns with low commissions

- Flexible risk management tools

- Access to both conservative and aggressive strategies

Affiliate Program

- Three reward models

- Daily commission payments

- Multilevel affiliate structure

- Supposed payout of over $4.3 million USD in the last year

While these features sound attractive, there is no independent verification that they function as promised. Many unregulated brokers use similar marketing strategies to lure in unsuspecting traders.

The Seychelles Warning in Detail

According to the official Seychelles FSA notice, Grand Capital Ltd claims to be an international brokerage for currency and derivatives trading. The addresses provided on their website are:

- Suite 102 Aarti Chambers, Mont Fleuri, Victoria, Mahe, Seychelles (Registered Office)

- No. 6, 1st Floor, Reliance Complex Building, Providence, Mahe, Seychelles (Business Address)

The FSA explicitly stated that Grand Capital Ltd is not regulated by them and that the company is operating unlawfully in Seychelles. This means that despite giving the appearance of legitimacy, Grand Capital has no legal license to offer financial services in that jurisdiction.

Global Regulatory Concerns

Beyond Seychelles, global financial watchdogs have highlighted multiple risks associated with this broker. Reports indicate that four separate pieces of regulatory information have been disclosed publicly, warning traders to exercise caution.

This is not unusual for unregulated offshore brokers, which often operate under loose legal frameworks that make it difficult for victims to recover lost funds.

Red Flags Summary

If we compile the warning signs, the picture becomes clear:

- Official Regulatory Warning – Seychelles FSA advises against dealing with Grand Capital.

- No Top-Tier Regulation – No oversight from reputable authorities like FCA, ASIC, or CySEC.

- Poor Online Reputation – Trustpilot score of 2.2 with mostly negative reviews.

- Complaints of Withdrawal Issues – Traders are reporting problems accessing their funds.

- Aggressive Marketing – High-return promises and flashy affiliate rewards.

- Offshore Registration – Located in a jurisdiction known for lax financial oversight.

These factors strongly suggest that Grand Capital may be a scam broker, and traders should avoid investing their funds with it.

The Risk of Offshore Brokers

Grand Capital’s base in Seychelles is a key part of the problem. Many scam brokers choose offshore jurisdictions because they can register cheaply, operate with little oversight, and avoid strict compliance requirements.

While not all offshore brokers are fraudulent, the absence of top-tier regulation is a major red flag—especially when the local regulator itself has issued a warning.

How to Protect Yourself

Before signing up with any broker, you should:

- Verify their license with an official regulator’s website

- Check for warnings from financial authorities

- Read independent reviews from multiple sources

- Avoid brokers with unverifiable claims of awards or client numbers

- Be cautious of bonuses that tie up your funds

Final Verdict – Is Grand Capital Legit?

Based on all available information, Grand Capital does not appear to be a safe or trustworthy broker. Its lack of regulation, official warning from the Seychelles FSA, poor online reviews, and suspicious marketing tactics make it a high-risk platform for traders.

If you’re looking to trade Forex or CFDs, it is highly recommended to choose a broker that is regulated by a reputable authority and has a proven track record of transparency and fairness.

Lost Money to Grand Capital or Another Scam Broker?

If you have invested with Grand Capital or any other broker and are facing withdrawal issues, there is still hope. Fraud Recovery Experts specializes in helping victims of scam brokers recover their funds. With professional knowledge of financial fraud, legal networks, and proven recovery strategies, they guide you through the process of reclaiming what’s rightfully yours. Don’t let scammers keep your hard-earned money—contact us today for a free consultation and take the first step toward getting your funds back.

For real-time updates, expert advice, and scam warnings, join us on: