The 365FX, also called Invest365, based on adequate evidence, has many traits of a fraudulent broker. This elaborate review of 365FX aims to give potential investors an insight into the broker’s operations, legitimacy, and risk nuances. If you are contemplating an investment with 365FX or have already made one, you should read this analysis to protect your financial interest.

Website and Domain Details

- Websites: https://365fx.org/ and https://365fx.net/

- Domain Age: The domain 365fx.org was registered on December 13, 2023, and is set to expire on December 13, 2024.

Ownership and Regulation

- Registered Address: Marshall Islands

- Regulation Status: Unregulated

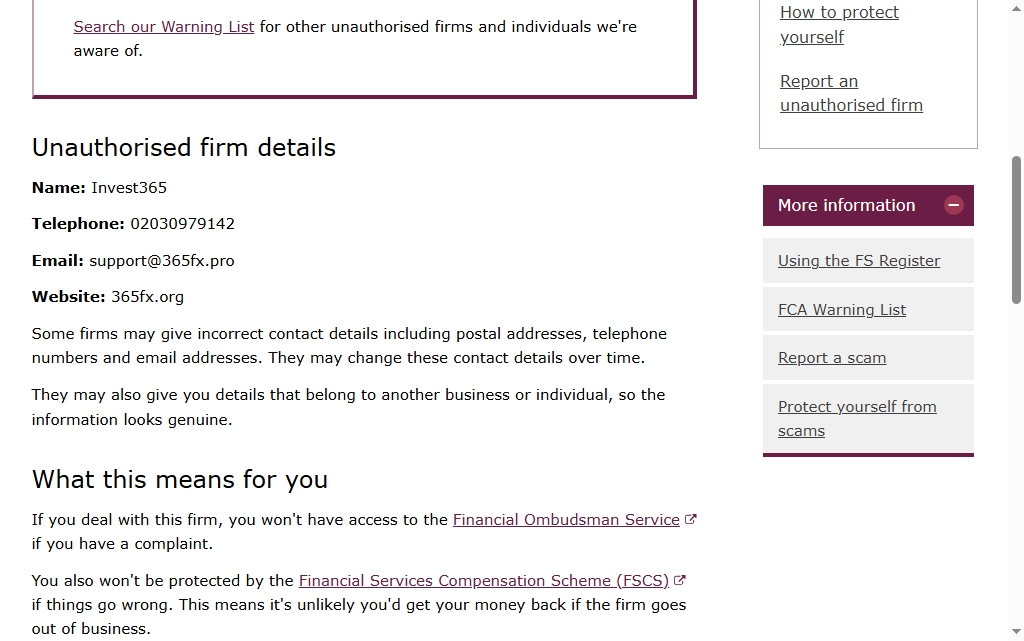

- Blacklisted by: Financial Conduct Authority (FCA), UK

Red Flags and Concerns

No Regulation

365FX is not working with any of the major financial regulatory authorities. Such lack of regulation raises serious alarms regarding the safety and security of the funds held in the name of their investors.

FCA Warning

The Financial Conduct Authority (FCA) has issued a warning regarding unregulated brokers such as this one, advising investors to stay away from companies that are not properly authorized. Always check a broker’s regulatory status on the FCA register before investing.

Offshore Registration

The broker is registered in the Marshall Islands with a jurisdiction that is characterized by comparatively lax regulatory requirements. This offshore registration is an option often available to Forex scam brokers to circumvent strict financial regulations.

Non-transparency

365FX’s websites contain little information on account types, deposit amounts, leverage, and other key trading information. Such opacity makes it hard for prospective investors to make an informed choice.

Negative Reviews and Complaints

Many online reviews and complaints talk of problems like withdrawal difficulties, unresponsive customer support, and aggressive solicitation tactics. These patterns are the same as scam brokers.

Recommendations for Potential Investors

- Regulatory Status Verification: Always check that the broker is registered and regulated by a financial authority of good repute for investment purposes.

- Carry Out Background Checks: Research the broker’s history, read customer reviews, and check trustworthy financial forums for comprehensive information.

- Be Highly Cautious with Offshore Entities: Give special attention to brokers under offshore registrations with dubious regulatory scrutiny.

- Reject High-Pressure Tactics: Reputable brokers will never pressure clients to invest quickly. Avoid excessive solicitation.

Conclusion

In light of the evidence presented, 365FX exhibits multiple warning signs associated with fraudulent brokers, including a lack of regulation, official warnings from financial authorities, offshore registration, and numerous negative reviews. Potential investors are strongly advised to avoid engaging with 365FX to protect their financial well-being.

Assistance for Victims

If you have fallen victim to the 365FX scam, it is crucial to seek professional assistance to recover your funds. Consulting with fraud recovery experts can guide the recovery process and improve the likelihood of retrieving lost assets.

Recovering Your Funds lost in the 365FX scam: Contact Fraud Recovery Experts

If you have fallen victim to the 365FX scam, don’t hesitate to reach out to Fraud Recovery Experts to recover your funds. We are dedicated to helping scam victims, and we offer a free consultation to guide you through the recovery process. Your financial well-being matters to us.

Read about Facebook Scams, Forex Trading Scams, Crypto currency Scams, Romance Scams, Social media scams, and others.