Yorker Capital Markets Review: Is it safe to deal with a Yorker Capital Markets broker?

Choosing an appropriate broker is essential for safe trading. This Yorker Capital Markets review entails all the important things you will need from Yorker Capital Markets.com to determine whether it is a safe platform or a lot of potential risks. The information available, customer feedback, and analysis of the industry are the basis of our Yorker Capital Markets review.

Yorker Capital Markets Broker Overview

- Website: https://yorkermarkets.com/

- Website Availability: NO

- Headquarters Country: No 202, 2nd Floor, Al Moosa Tower-2, Sheikh Zayed Road, Dubai.

- Owned By: NA

- Blacklisted by: NA

- Domain Age:

- Name-YORKERMARKETS.COM

- Registry Domain ID-2798880212_DOMAIN_COM-VRSN

- Registered On-2023-07-17T10:30:20Z

- Expires On-2033-07-17T10:30:20Z

- Updated On-2025-04-12T12:49:51Z

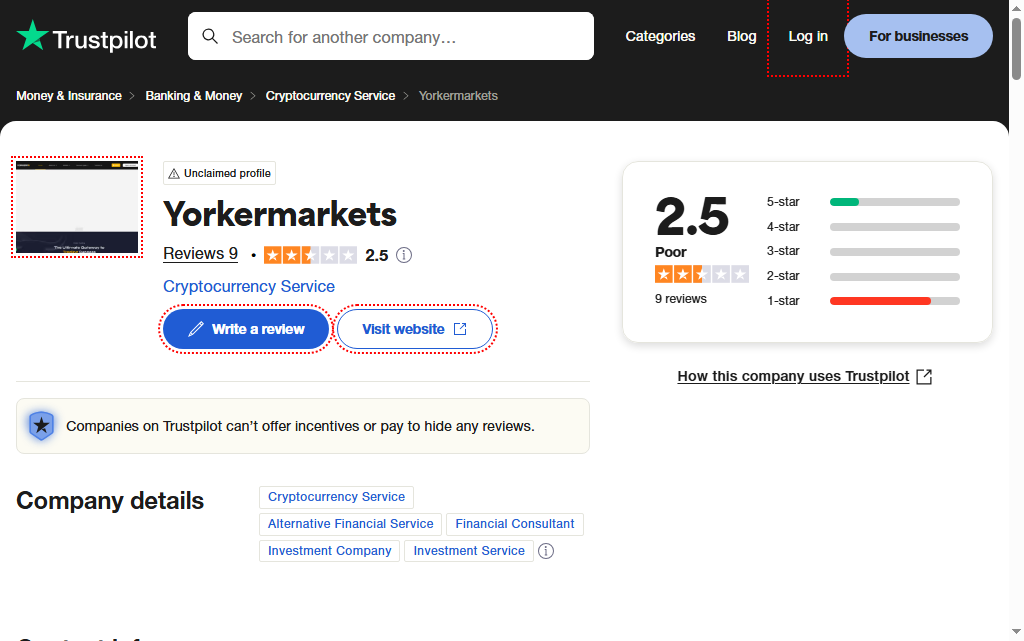

Negative Trustpilot Reviews

Many of these users have left negative reviews on Trustpilot, citing disappointment with their experience using this platform. The typical complaints include withdrawing issues, bad customer service, false advertising, and potential fraudulent activity. Though individual experiences can differ, the general Trustpilot rating invokes unease regarding the website’s legitimacy and credibility. It is advisable for prospective investors to review third-party feedback and use caution before financially committing.

Investor Complaints and Concerns

Several investors have complained about unsettling experiences with Yorker Capital Markets Ltd, a brokerage firm that promises comprehensive forex and CFD trading opportunities. After being advertised as a secure and professional trading platform, users have encountered problems like delayed withdrawals, unsatisfactory customer services, and technological issues with trade completion.

One investor said that after being drawn in by the company’s marketing hype, their experience soon became a negative one. The broker’s MetaTrader 5 (MT5) platform often experienced lags, and support was slow to respond during key trading times. More troubling were the repeated delays in withdrawals, with some users saying their requests were completely ignored.

Regulatory Red Flags

Yorker Capital Markets is regulated by the Mwali International Services Authority (MISA) in Comoros—a regulatory environment that has poor regulatory oversight. In addition, the broker does not appear on the lists of reputable regulators such as the FCA, ASIC, CySEC, or the DFSA (Dubai). The lack of regulation significantly raises the investor risk, particularly in a sector where trust and transparency are of utmost importance.

Lack of Transparency and Online Presence

The website of the broker offers very little information regarding the company structure, regulatory position, or management. Additionally, the broker maintains scant social media presence and public forum activity, limiting clients from reaching out to get real-time updates or interacting openly with the company.

Although Yorker Capital Markets promotes a varied array of accounts and high-leverage trading options, these advantages are overshadowed by serious concerns regarding regulation, customer support, and platform integrity. Third-party feedback consistently points to dubious practice and financial losses. Investors should exercise extreme caution and seek alternative, better-regulated options for safeguarding their capital.

Concerns Surrounding Yorker Capital Markets

1. Importance of Regulatory Information

These regulatory oversight rules largely determine the brokers’ reliability. If they fail to give clear information about their license and regulatory status and just operate without explaining all this to the traders, it may be difficult for them to verify the broker’s credibility. A good thing to do is to ensure that the broker is under proper regulations before you invest.

2. User Feedback and Trading Experience

Online reviews are often relied upon by traders to show platform reliability. Discussions on various online forums quote that users have had different experiences in their dealings with Yorker Capital Markets. Some traders report delayed processing of withdrawals, troubled customer support experiences, or raised fee concerns.

3. Website and Operational Transparency

A trustworthy broker typically provides clear information about its services, terms, and policies. Examining Yorker Capital Markets website structure, operational history, and domain age can offer insights into its transparency and credibility.

User Reviews and Feedback

What Traders Are Saying

Online discussions and independent review sites have mixed opinions about Yorker Capital Markets. Some traders are touting the positive experiences while others have concerns. Feedback from several sources should be reviewed before making a decision.

Why Reviews Matter

By analyzing feedback from users, potential traders may notice directions in customer satisfaction, operational efficiency, and support services. Cross-checking such information with a practitioner’s association and the regulatory body further affirms any decision.”

How to Protect Yourself When Choosing a Broker

Conduct Complete Research

The history of the broker, its regulatory status, and feedback from its clients must be investigated before opening an account. A trustworthy broker shall disclose credentials.

Verify Any Information with an Independent Source

Apart from their websites, regulatory agencies and review sites should always be consulted to get two-sided opinions about their activity.

Avoid Any Kind of Pressure

Any broker that urges you to make an immediate investment based on promises of quick returns requires caution.

Secure Your Data

Protect sensitive data, including banking details and identification. If a trading platform takes security measures, it is responsible for protecting such user details.

Report Bad Behavior

In the case any unusual activities are observed with a broker, informing the authorities will be of great help to many other traders.

Yorker Capital Markets Review Conclusion

The Yorker Capital Markets review gives the essential highlights that should guide a trader into the Yorker Capital Markets.com platform. While some may probably find the site okay, self-evaluation becomes necessary to ensure the judgment of information such as transparency, user feedback, and regulation. Moreover, carrying out thorough research and verification of credentials can render a little more safety in the trading experience.

Need Assistance with Fund Recovery?

If you have encountered issues with a trading platform, professional guidance may be beneficial. Fraud Recovery Experts offer a free consultation to assist individuals in exploring fund recovery options.

For updates and discussions, follow us on:

Stay informed and trade wisely!