Before investing, it is essential to understand the potential risks associated with online brokers. This Bitget review presents potential red flags based on consumer complaints, industry alerts, and regulatory observations. None of these confirms wrongdoing, but Bitget could display some of these red flags, and careful examination is suggested.

Bitget Overview

- Website: https://www.bitget.com/

- Website Availability: Yes

- Headquarters Country: Seychelles

- Owned By: Bitget

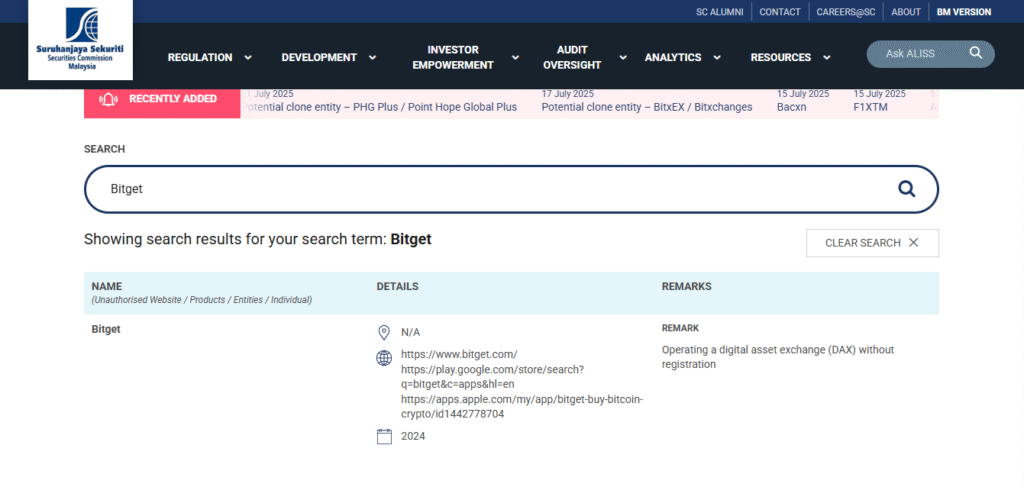

- Blacklisted by: The Securities Commission Malaysia

- Domain Blacklisted Status: It seems there is no direct mention of this domain being on a blacklist.

Prefer watching instead?

We’ve created a short video summarizing the key red flags of Bitget. Watch it here:

Red Flags That May Apply

Online trading platforms often share common red flags that may indicate they are unsafe or potentially fraudulent. While not every platform with these traits is a scam, if a broker shows any of the following warning signs, it’s best to proceed with extreme caution or avoid it entirely.

Common Red Flags Seen:

- Unverified Regulation

Platforms without confirmed licenses from respected authorities like the FCA, ASIC, CySEC, or CFTC should raise concern. Bitget may not appear in official regulatory databases.

- Withdrawal Delays or Blocks

Some users have reported difficulty accessing their funds. Delayed or denied withdrawals are often mentioned in scam-related complaints.

- Hidden or Excessive Fees

Brokers sometimes apply surprise fees for inactivity, platform usage, or withdrawals that were not made clear during signup.

- Pushy Deposit Tactics

High-pressure strategies, such as repeated calls or messages urging users to invest more for VIP access or bonus unlocks, are a known scam pattern.

- Unrealistic Earnings Claims

If Bitget Broker advertises guaranteed high profits with little or no risk, this may be a serious red flag.

- Suspicious or Fake Reviews

Some platforms promote overly positive reviews that lack specifics like dates, usernames, or verified experiences. This may be done to cover up negative feedback.

These signs do not automatically mean Bitget is a scam, but even one or two of these issues could point to a risky or untrustworthy platform. It’s better to avoid any broker that displays these behaviors.

What to Check Before Investing

Before depositing money, make sure you:

- Verify Regulation – Confirm the broker’s license on official regulatory sites (e.g., FCA, ASIC, CySEC, CFTC, NFA). Avoid unverified claims.

- Read Withdrawal Terms – Understand how and when you can withdraw, plus associated fees.

- Test Customer Support – Send inquiries before signing up. Significant delay or unhelpful answers may be red flags.

- Inspect Trading Platform – Use a demo account to check functionality; watch for slow execution or fake price feeds.

- Review Real User Feedback – Search reputable forums and look for detailed complaints, not just vague praise.

- Start Small – Deposit a minimal amount and attempt a small withdrawal first to confirm legitimacy.

Why Unregulated Platforms Are Risky

Without oversight, brokers are not required to:

- Keep client funds in segregated accounts.

- Publish audited reports or financial statements.

- Offer dispute resolution or investor protection.

Investing in unregulated brokers can leave users exposed to fund misuse, manipulation, or total loss.

Platform and Account Conditions to Check

Bitget Broker may let you trade forex, crypto, or CFDs, but here are some things to watch out for:

- Bonus Conditions: Deposit bonuses might lock your money until you trade a lot.

- Platform Issues: Users have reported slow loading, price errors, or being logged out.

- Confusing Account Levels: VIP or premium features may only be explained after you deposit.

- Slow KYC Process: Delayed verification could be used to hold your funds.

- Mismatch in Features: The live platform might not work like the demo.

These problems may not affect everyone, but many users have mentioned them, so always double-check before investing.

Frequently Asked Questions

Q1: Is Bitget regulated?

Check official regulator websites. If not listed, Bitget likely lacks proper license and accountability.

Q2: What if withdrawals fail?

Start documenting all transactions, chat logs, and communications. Rapid action can help when seeking recovery.

Q3: Can reviews be trusted?

Look for reviews with specific details, timeframes, trade info, or transaction IDs—generic praise is often untrustworthy.

Q4: What to do if pressured to deposit more?

Pause all communication. Don’t send more funds. Consult fraud recovery services and regulatory bodies.

Q5: How to proceed safely?

Verify the regulation, test small deposits, read all policies, and confirm platform reliability before committing significant funds.

Conclusion: Are You Safe with Bitget Broker?

Bitget may possess attributes typical of unregulated or high-risk platforms, e.g., unclear fees, withdrawal issues, and high-pressure upselling, amongst others. While none of these seem to indicate misconduct, they do highlight the significance of conducting adequate research before investing.

How Fraud Recovery Experts Can Help

If you suspect you’ve lost funds to Bitget or a similar platform, Fraud Recovery Experts offers:

- Expert guidance for recovering funds

- Help documenting evidence and communications

- Support in navigating regulatory and legal options

Contact us now and take the first step toward reclaiming your financial security.

For updates and discussions, follow us on:

Stay informed and trade wisely!